Chains

BNB Beacon Chain

BNB ecosystem’s staking & governance layer

Staking

Earn rewards by securing the network

Build

Explore

Accelerate

Connect

Careers🔥

Explore Opportunities on BNB Chain

A Deep Dive into Stock Tokenization

Updated Aug 1, 2025

Special thanks to Securitize and Backed Finance (xStocks) for their review.

Tokenizing real-world stocks compresses two-day settlement cycles into seconds, enables programmable assets, and unlocks 24/7 global trading. Yet the sector remains small—roughly $370 million compared to $120 trillion in global equities.

This blog explores:

- Key design considerations for security tokens;

- Best practices and standards on BSC/EVM chains, with protocol examples;

- Opportunities for improvement in compliance, infrastructure, and liquidity.

We’ll break down what’s live today, the regulatory roadblocks, and how tokenized stocks could grow 10× by 2026.

1. Mechanism of Tokenized Stocks

Stock token designs span a spectrum: on one end, compliant custodial wrappers offer only price exposure with limited DeFi utility; on the other, fully composable on-chain synthetics maximize DeFi access but confer no real shareholder rights and face stricter derivatives regulation. As mentioned in various discussions:

2. Market Snapshot

- Tokenized‑stocks TVL: $370M across 167 assets (RWA.xyz).

- xStocks volume: Daily $134M(Coinmarketcap).

- Market Potential: If just 0.002% of global equities are tokenized by 2026, the market could reach ~$3B. While still nascent, tokenized equities are showing early signs of traction—and the room for growth is massive.

3.The Tokenized-Stock Trilemma

Token issuers must juggle three goals that pull in different directions:

Core insight: a design can excel at any two pillars, but the third will be compromised:

- Compliance + Ownership → tokens sit in a closed, KYC-walled environment with little DeFi reach

- Compliance + Composability → wrappers trade freely but only give price exposure (no voting).

- Ownership + Composability → would deliver “real shares in DeFi” but currently clashes with most securities laws.

4. Compliance Implementation

Bringing real-world equities on-chain is impossible without robust identity controls. Today every live product relies on one of two whitelisting mechanisms:

Smart-Contract Registry in Action

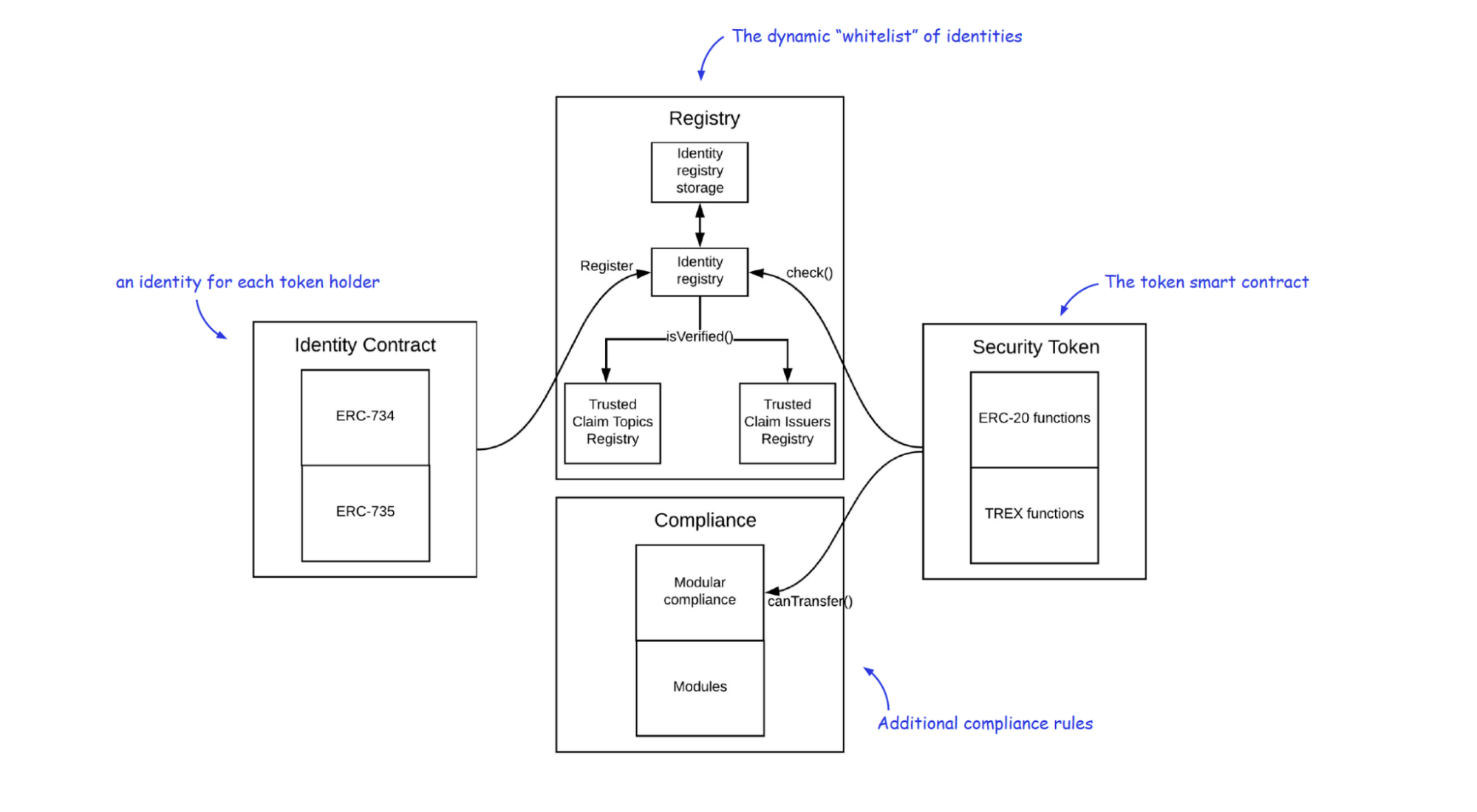

ERC-3643 (initially known as T-REX) illustrates the on-chain model:

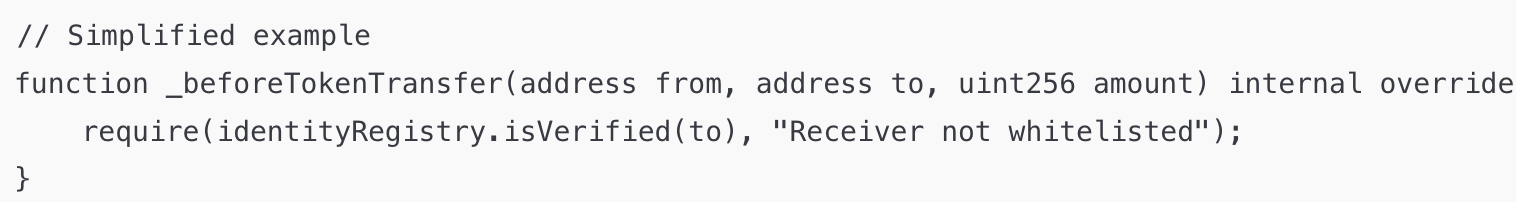

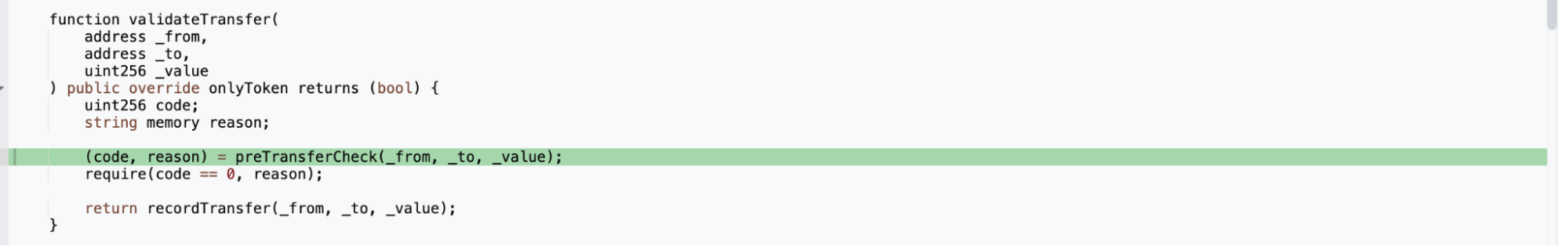

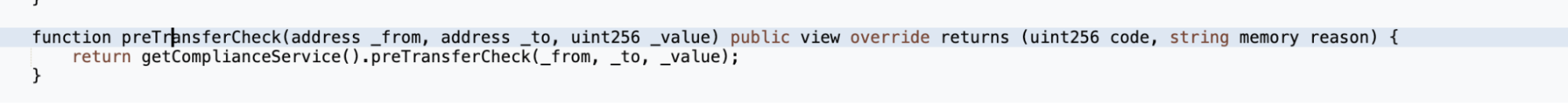

Every transfer runs isVerified(). Securitize uses the same logic, even if its contracts don’t formally signal ERC-3643 compliance. When users transfer tokens, the preTransferCheck will be executed to see if the receiver is on the registry.

https://etherscan.io/address/0x9e2693f54831f6f52b0bb952c2935d26919a3626#code#F18#L51

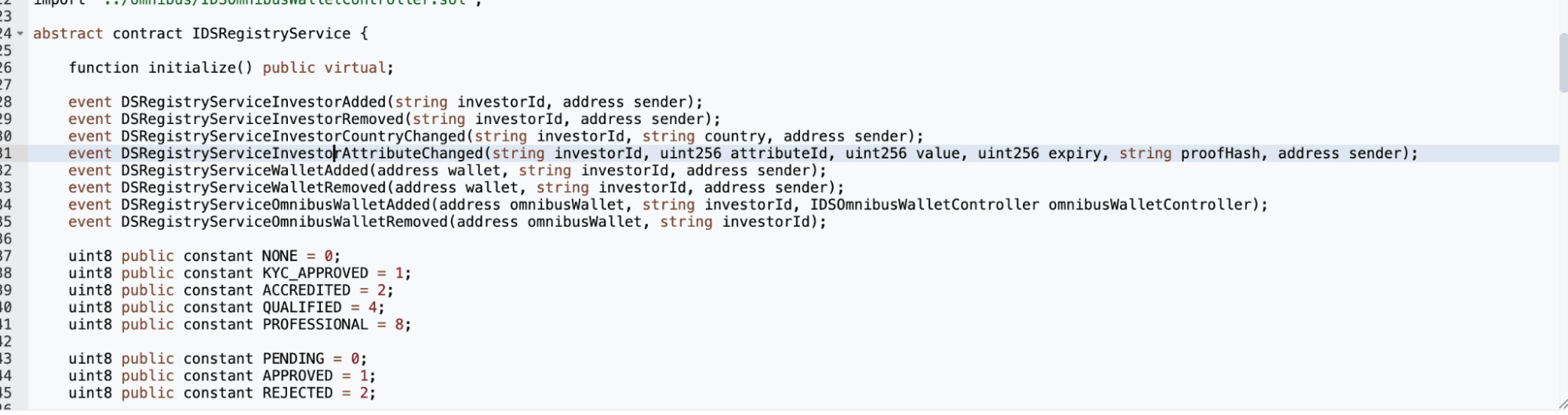

Registry is designed to allow registered investors by wallet address.

https://etherscan.io/address/0x9e2693f54831f6f52b0bb952c2935d26919a3626#code#F36#L18

Custodial Control – The xStocks Case Study

xStocks show how a single entity can satisfy regulators and still issue tokens that are usable in DeFi once minted. The “Trust Stack” Behind CRCLx (Circle Tracker Certificate):

Ownership reality: CRCLx is a tracker certificate—holders get price exposure, and have the primary claim to the collateral value. They do not have voting rights, but dividends and splits are managed via rebasing.

Result: xStocks reconciles the regulator’s need for strict KYC at the capital-formation edge with DeFi’s demand for permissionless liquidity after issuance.

5. Potential Challenges

- Regulatory FragmentationSecurities rules, KYC standards, and custody requirements differ sharply across the U.S., EU, Asia, and offshore hubs—forcing issuers to geo-fence users or launch multiple wrappers.

- Ownership vs. Compliance Trade-offGranting full shareholder rights (dividends, voting) triggers stricter securities treatment; most projects settle for price-tracker certificates, limiting investor appeal.

- Corporate-Action PlumbingStock splits, mergers, and dividend events must update token supply and metadata in real time; today this is still a manual—or at best semi-automated—process prone to error.

- Proof-of-Reserve & Custody RiskTokens are only as trustworthy as the oracle showing that real shares remain in custody; stale data or a custodian failure undermines the entire instrument.

- UX Friction Around KYCOn-chain registry checks (ERC-3643 style) add gas cost and onboarding steps, while off-chain custodial gates break composability—both hurt adoption.

The small scale of today’s tokenized stock market — with just 0.0003% of global equities on-chain — reflects how early we are in the adoption curve, much like in the early days of stablecoins. As the market matures, adoption will hinge on the product features that prove most valuable — including DeFi composability, free transferability, regulatory compliance, and structural robustness.