Chains

BNB Beacon Chain

BNB ecosystem’s staking & governance layer

Staking

Earn rewards by securing the network

Build

Explore

Accelerate

Connect

Careers🔥

Explore Opportunities on BNB Chain

RWAs on BNB Chain: A Landscape Overview

Bringing real-world assets (RWAs) onchain is no longer theory. Billions in Treasuries, credit, metals, and more are already transacting across blockchains. The big question now: which networks are turning pilots into production at scale?

BNB Chain is emerging as one of the strongest answers.

BNB Chain has evolved into the most complete RWA stack: compliant issuance, secondary liquidity, and DeFi utility all in one ecosystem. That combination makes BNB Chain the natural home for projects that want to move beyond proof-of-concept and into production at scale.

In this post, we’ll map the RWA flywheel on BNB Chain, spotlight the milestones that prove its leadership, and share where we’re taking the category next.

Why RWAs Choose BNB Chain

While many chains are still experimenting with RWA pilots, BNB Chain already offers the most complete stack for tokenization at scale. The foundation is our One BNB architecture:

- BNB Smart Chain for secure, low-cost execution and realtime finality

- opBNB for high-throughput rollups

- Greenfield for decentralized data storage

Together, they form a purpose-built environment that issuers can’t find elsewhere: fast settlement, low fees, and compliant data tooling in one ecosystem.

And we go beyond infrastructure. Our RWA Incentive Program offers liquidity support, growth funding, compliance resources, and technical guidance. It signals a long-term commitment to making tokenization succeed on the BNB Chain.

That mix of architecture plus direct support is why regulated issuers, DeFi protocols, and institutions are converging here. Early partners like Matrixdock, Brickken, and InvestaX show how tokenization platforms can scale faster on BNB Chain than anywhere else.

BNB Chain isn’t just part of the RWA wave, it’s where projects gain momentum.

Key Milestones in 2025

This year, leading issuers have chosen BNB Chain to take RWAs mainstream:

- Circle’s USYC arrives natively. USYC, backed by short-term Treasuries and repo, is built for institutional adoption. This enables USYC users to more seamlessly explore the onchain world and potential of tokenized traditional assets.

- Securitize and VanEck launch VBILL. Tokenizing a U.S. Treasury fund demands regulatory-grade infrastructure. By launching VBILL through Securitize on BNB Chain, VanEck gains secure issuance, programmable compliance, and immediate access to secondary liquidity venues already active in our ecosystem.

- Ondo and xStock set to launch. Ondo and xStock are bringing tokenized Treasuries, equities, and structured assets to BNB Chain, underscoring its role as the network of choice for institutional-grade RWAs.

Together, these milestones show that BNB Chain is not only attracting credible issuers but also connecting them to liquidity venues and institutional workflows.

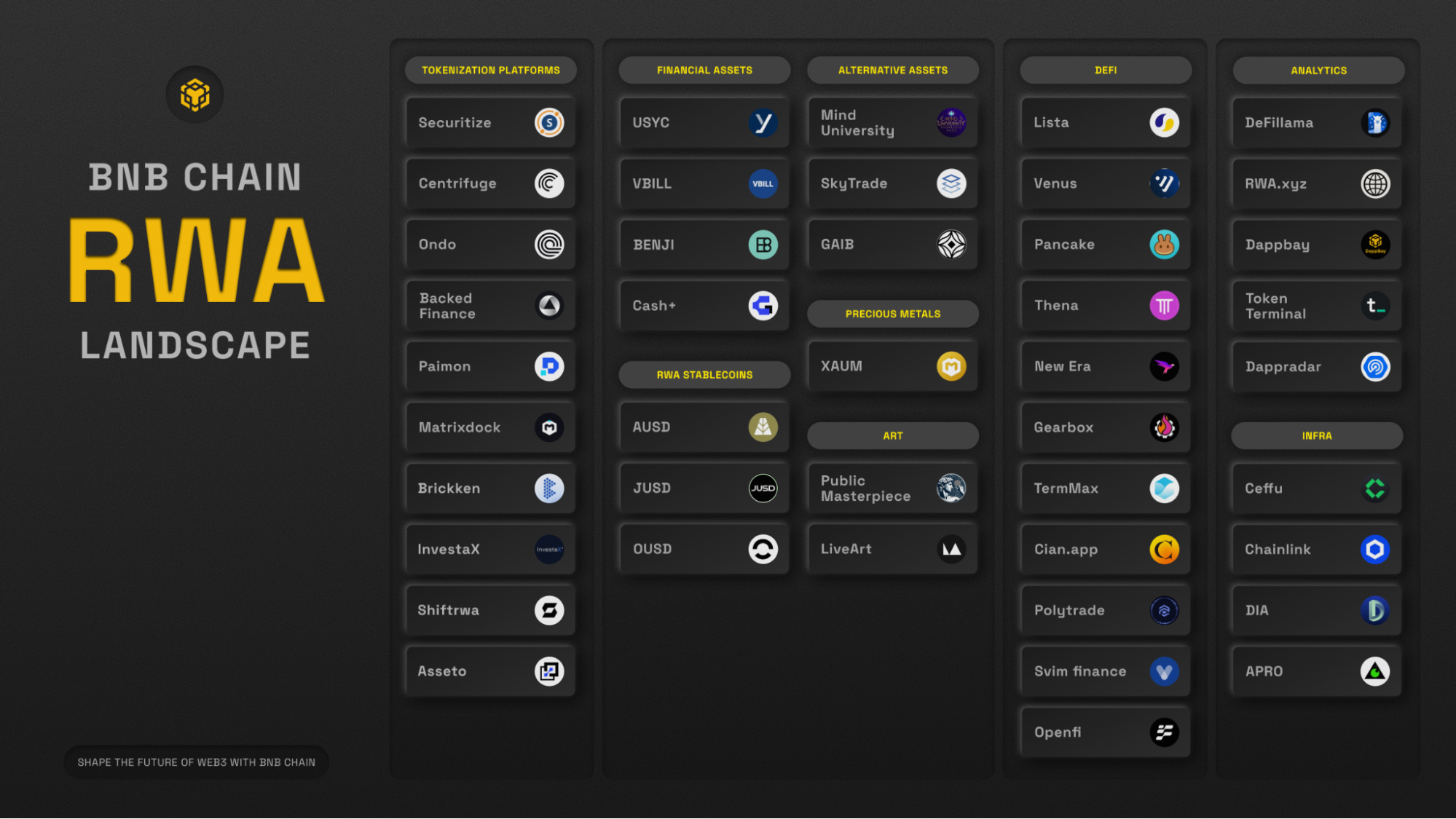

Mapping the RWA Landscape on BNB Chain

RWAs need more than issuance. They need liquidity, DeFi utility, and trusted infrastructure working together, and that’s what’s forming on BNB Chain with the current landscape:

- Tokenization Platforms – Securitize, Centrifuge, Ondo, Backed Finance, Paimon, Matrixdock, Brickken, InvestaX, Asseto

- Financial Assets – USYC, VBILL, BENJI, Cash+

- RWA Stablecoins – AUSD, JUSD, OUSD

- Alternative Assets – Mind University, SkyTrade, GAIB

- Precious Metals – XAUm (Matrixdock)

- Art – Public Masterpiece, LiveArt

- DeFi – Lista, Venus, PancakeSwap, Solv Thena, New Era, Gearbox, TermMax, Cian.app, Polytrade, Svim Finance, Openfi

- Analytics – DeFiLlama, RWA.xyz, DappBay, Token Terminal, DappRadar

- Infra – Ceffu, Chainlink, DIA, APRO, Trust Wallet

This isn’t a loose collection of projects, it’s a connected ecosystem where each layer feeds the next: issuance creates assets, liquidity makes them tradeable, DeFi unlocks utility, analytics and infra ensure trust, and institutions can finally engage at scale. That’s why BNB Chain is one of the only places where RWAs can operate end-to-end.

Looking Ahead

BNB Chain’s RWA strategy is clear: this is where the standards for tokenization are being set. We don’t just make onchain assets possible but we make them useful, compliant, and liquid at scale.

The shift ahead is bigger than putting legacy assets on new rails. It’s about programmable finance: assets that settle instantly, enforce compliance in code, and compose into entirely new products. That future isn’t theoretical - it’s already taking shape on BNB Chain.

If you want to bring RWAs onchain, BNB Chain is where you do it. Build with us.

Follow us to stay updated on everything BNB Chain

Website | Twitter | Telegram | Facebook | dApp Store | YouTube | Discord | LinkedIn | Build N' Build Forum